India’s digital payment landscape is rapidly evolving, with QR code payments playing a central role. These convenient and secure transactions are pushing cashless adoption across merchants of all sizes and customer segments. To facilitate this growth, several innovative companies offer QR payment API solutions, empowering businesses to integrate QR payments into their applications and websites.

Key Players in the QR Payment API Space:

- Eko: A leading fintech company, Eko offers a comprehensive QR payment API with features like dynamic QR code generation, real-time settlements, and instant notifications.

- Razorpay: This popular payment gateway provides a robust QR code solution with multi-source acceptance (UPI, cards, wallets) and customization options.

- FidyPay: Focused on small and medium-sized businesses, FidyPay offers low-cost, interoperable QR code solutions with remote customer and merchant management.

- ZuelPay: This API service provider allows merchants to accept payments through UPI ID and QR codes at competitive rates.

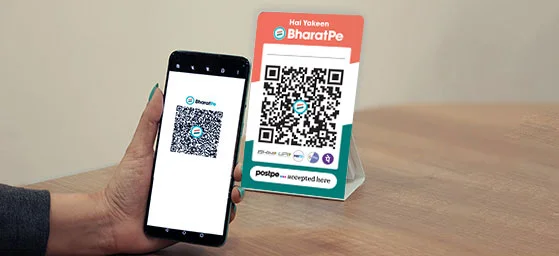

- BharatPe: Primarily targeting SMBs, BharatPe’s QR code solution allows them to receive instant settlements and process quick refunds.

Beyond these top players, numerous other companies cater to specific niches or offer unique features, such as:

- Paytm: India’s digital payments giant provides QR code solutions tailored to large enterprises and e-commerce platforms.

- Google Pay: This widely used digital wallet offers its own QR code solution for seamless in-person payments.

- Decentro: This company focuses on dynamic QR codes, allowing merchants to update information without regenerating the code.

Choosing the Right QR Payment API:

When selecting a QR payment API, consider factors like:

- Pricing: Compare transaction fees, monthly charges, and any setup costs.

- Features: Assess functionalities like dynamic QR codes, multi-source payments, and data analytics.

- Target audience: Choose a solution aligned with your customer base and business type.

- Security: Ensure compliance with industry standards and data protection regulations.

- Integrations: Verify compatibility with your existing systems and preferred platforms.

The Future of QR Payments in India:

The QR payment API market in India is poised for continued growth, driven by government initiatives, rising smartphone penetration, and increasing consumer preference for cashless transactions. As technology evolves, expect further innovations like dynamic pricing, data-driven marketing, and integration with loyalty programs.

Additional Notes:

- This article is not an exhaustive list and represents a snapshot of the market as of February 17, 2024.

- It is recommended to conduct thorough research and compare offerings before making a decision.