Personal Loan Calculator Details: Everything You Need to Know

In today’s fast-paced world, personal loans have become a vital financial tool for managing unexpected expenses, funding dream projects, or consolidating debt. Whether it’s for a wedding, travel, medical emergency, or home renovation, personal loans offer quick access to funds without the need for collateral. But before applying for a loan, understanding the repayment structure is essential—and that’s where a personal loan calculator comes into play.

A personal loan calculator is a simple yet powerful digital tool that helps borrowers estimate their monthly repayments, total interest, and overall loan cost. This article delves into the details of a personal loan calculator, how it works, its benefits, and how to use it effectively.

What Is a Personal Loan Calculator?

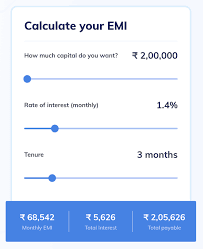

A personal loan calculator is an online tool that allows individuals to calculate the Equated Monthly Installment (EMI) they would need to pay on a personal loan. The calculator considers three main inputs:

- Loan Amount – The total amount you wish to borrow.

- Interest Rate – The annual rate charged by the lender.

- Loan Tenure – The duration (in months or years) over which the loan is to be repaid.

By inputting these values, the calculator instantly provides:

- The monthly EMI

- The total interest payable

- The total repayment amount

It removes the need for complex manual calculations and gives you a clear picture of your financial obligations.

Why Use a Personal Loan EMI Calculator?

There are several compelling reasons why anyone considering a personal loan should use an EMI calculator:

1. Financial Planning

Knowing your EMI in advance helps you manage your monthly budget. You can plan your income and expenses efficiently without overburdening your finances.

2. Time-Saving and Accurate

Manual EMI calculation using the formula is time-consuming and prone to errors. A calculator provides instant and accurate results with just a few clicks.

3. Loan Comparison

By adjusting the loan amount, interest rate, and tenure, you can compare different loan offers from multiple lenders. This helps in selecting the most affordable and suitable option.

4. Understanding Interest Burden

It breaks down the repayment into principal and interest, helping you understand how much you’re actually paying over the loan period.

5. Decision-Making Tool

With a clear repayment structure in mind, borrowers are in a better position to negotiate terms with lenders or reconsider the loan amount or tenure.

How Does the Personal Loan Calculator Work?

The personal loan EMI is calculated using the standard mathematical formula:

EMI = \frac{P \times R \times (1 + R)^N}{(1 + R)^N - 1}

Where:

- P = Principal loan amount

- R = Monthly interest rate (Annual Rate ÷ 12 ÷ 100)

- N = Loan tenure in months

Example Calculation:

Suppose you borrow ₹5,00,000 for 3 years at an annual interest rate of 12%.

- P = 500,000

- R = 12 / 12 / 100 = 0.01

- N = 36 months

EMI = \frac{500000 \times 0.01 \times (1 + 0.01)^{36}}{(1 + 0.01)^{36} - 1}

Using a calculator, the EMI comes out to around ₹16,607. The total interest payable would be approximately ₹97,858, and the total amount repaid would be ₹5,97,858.

Key Features of a Good Personal Loan Calculator

When using an online personal loan calculator, here are the key features you should look for:

1. User-Friendly Interface

The calculator should be easy to use with intuitive sliders or input fields for loan amount, interest rate, and tenure.

2. Instant Results

A good calculator gives real-time results as you change values.

3. Graphical Breakdown

Visual representation in the form of pie charts or bar graphs showing principal vs interest, and amortization schedule.

4. Amortization Table

It provides a month-wise or year-wise breakdown of EMIs, helping borrowers track their repayment journey.

5. Mobile Responsive

It should work efficiently on both desktop and mobile devices.

Benefits of Using a Personal Loan Calculator Before Applying

✅ Saves Time and Effort

You don’t need to contact multiple banks or use spreadsheets. In a few seconds, you get a full financial picture.

✅ Empowers Informed Decisions

Compare offers based on real numbers, not just promotions or advertisements.

✅ Helps in Loan Negotiation

If you’re aware of what a fair interest rate looks like, you can negotiate better terms with lenders.

✅ Prepares You for Loan Approval

Some banks also use EMI calculators internally to check if your income-to-debt ratio supports the EMI.

Factors That Influence EMI Calculations

Several factors influence the EMI you’ll pay, and knowing them helps in making smarter financial decisions:

1. Loan Amount

Higher loan amounts result in higher EMIs.

2. Interest Rate

Even a 1% difference in interest rate significantly affects the EMI and total interest.

3. Tenure

Longer tenures reduce monthly EMI but increase total interest. Shorter tenures mean higher EMIs but lower interest payout.

4. Processing Fees and Other Charges

Some calculators include additional charges, which affect your overall cost of borrowing.

Tips for Using a Personal Loan EMI Calculator Effectively

- Use Realistic Values: Enter interest rates based on current market offerings.

- Try Multiple Combinations: Adjust tenure and loan amount to find the best fit.

- Compare Lenders: Use calculator results to compare different banks or NBFCs.

- Consider Prepayment Scenarios: Some advanced calculators show the effect of part prepayments on your loan.

Common Mistakes to Avoid

Even with the best calculators, some users make errors that lead to inaccurate planning. Avoid these pitfalls:

- Ignoring Interest Rate Variations – Don’t assume all lenders offer the same rate.

- Choosing the Longest Tenure Always – It may lower EMI but increase the total interest drastically.

- Overestimating Loan Eligibility – Just because EMI seems affordable doesn’t mean you qualify for that amount.

- Not Considering Prepayment Charges – If you plan to close the loan early, factor in any penalties.

Where to Find Reliable Personal Loan Calculators?

Many trusted financial platforms offer free online calculators. Here are some sources:

- Bank Websites – HDFC, SBI, ICICI, Axis Bank, etc.

- Financial Marketplaces – Paisabazaar, BankBazaar, Cred, etc.

- Loan Aggregator Apps

- Fintech Blogs and Tools

Make sure the website is secure and the calculator is regularly updated with current market rates.

Advanced Personal Loan Calculators

Some calculators go beyond basic EMI estimation and offer features such as:

- Prepayment and Foreclosure Impact

- Interest Savings Calculator

- Loan Eligibility Estimator

- Debt Consolidation Planner

These tools are particularly useful for those managing multiple debts or planning an early closure of the loan.

Conclusion

A personal loan calculator is more than just a convenience—it’s a critical financial planning tool. Whether you are a first-time borrower or a seasoned one, using an EMI calculator helps you understand the full scope of your borrowing decision. It offers clarity, saves time, and ensures you’re not caught off guard by monthly obligations or hidden costs.