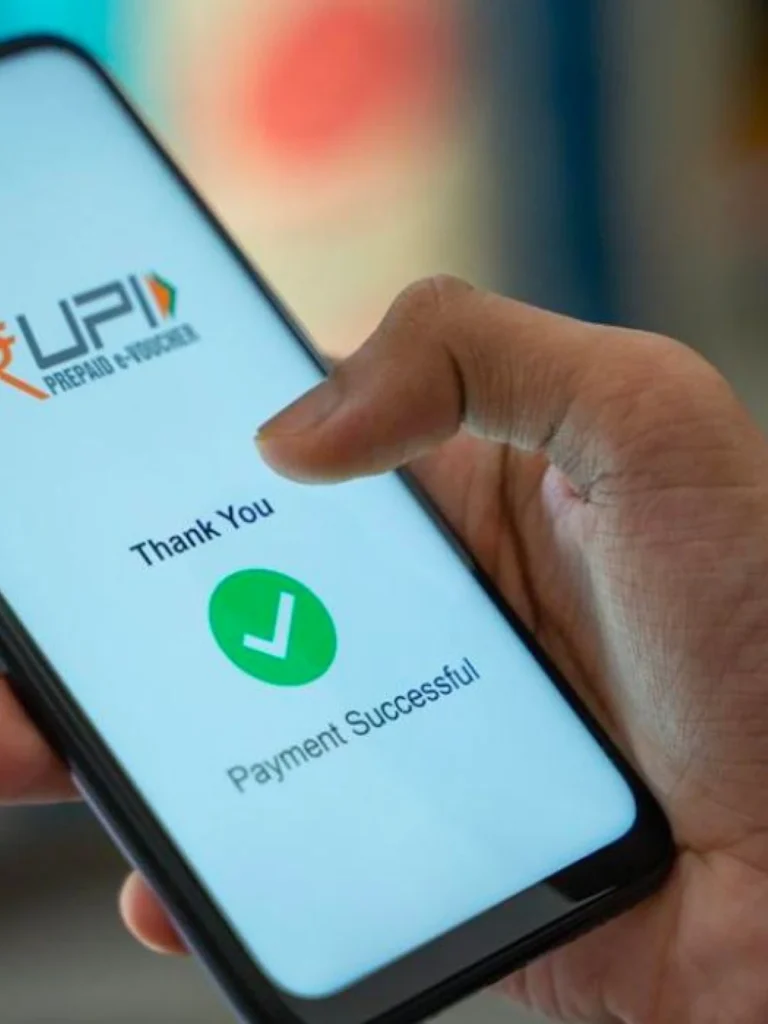

The Reserve Bank of India (RBI) has recently announced a significant update to the Unified Payments Interface (UPI) transaction limits, raising the maximum amount for specific categories from Rs. 1 lakh to Rs. 5 lakh. This change marks a major step forward in facilitating high-value payments through the widely popular digital platform.

Key Points of the New Rule:

- Increased transaction limit: The maximum transaction limit for specific categories, including payments to hospitals, educational institutions, and for investments in the Initial Public Offering (IPO) and Retail Direct Scheme, has been raised to Rs. 5 lakh.

- Benefits: This change enables users to make high-value payments seamlessly and conveniently through UPI, eliminating the need for traditional methods like bank transfers or physical cash.

- Categories covered: The increased limit currently applies to payments in the following categories:

- Hospitals

- Educational institutions

- IPO subscriptions

- Retail Direct Scheme investments

- Mutual funds

- Insurance premium payments

- Bill payments and payments to merchants

- Tax payments

- Remittances

- Collections

- Bank-specific daily limits: While the increased limit applies to specific categories, individual banks may impose their own daily transaction limits, which can range from Rs. 25,000 to Rs. 1 lakh.

Impact on Users:

The new rule is expected to have a positive impact on users in several ways:

- Enhanced convenience: High-value payments can now be made with greater ease and efficiency through UPI, saving time and effort.

- Improved financial inclusion: By facilitating larger transactions, UPI becomes more accessible for individuals and businesses alike, further promoting financial inclusion in the country.

- Reduced reliance on other methods: The increased limit reduces the need for users to rely on traditional methods like bank transfers or physical cash for high-value payments.

- Increased usage: This change is likely to encourage wider adoption and usage of UPI for a broader range of transactions.

Overall, the new UPI transaction limit rule represents a significant step towards making digital payments more convenient and accessible for everyone in India. It is a positive development that will benefit both individuals and businesses, further strengthening the country’s digital payments ecosystem.

Key Changes:

- Increased Transaction Limit: The maximum per-transaction limit for specific categories like healthcare, education, and insurance has been raised from Rs. 1 lakh to Rs. 5 lakh. This significantly simplifies payments for large hospital bills or educational fees.

- E-Mandate Changes: Recurring payments for utility bills, subscriptions, and other services will now require users to explicitly provide an e-mandate. This adds a layer of security and control over recurring transactions.

- Interchange Fee: The NPCI has recommended an interchange fee of up to 1.1% on UPI transactions exceeding Rs. 2,000 made through Prepaid Payment Instruments (PPIs). This fee will be applicable from April 1, 2023, and may impact some users’ transaction costs.

What You Need to Do:

- Review Transaction Limits: Familiarise yourself with the new transaction limits applicable to your needs. Remember, the general daily limit remains at Rs. 1 lakh, while specific categories like healthcare now have a higher limit of Rs. 5 lakh.

- Provide E-Mandates: For recurring payments, ensure you provide an e-mandate through your UPI app. This will allow seamless deductions for your chosen services.

- Stay Informed: Keep yourself updated about any further changes or updates to the UPI ecosystem through official channels like the NPCI website or your bank’s communication.

Impact and Benefits:

The new UPI rules offer several benefits for users and businesses:

- Increased Convenience: Larger transactions can be processed more easily, especially for critical payments like medical bills.

- Enhanced Security: E-mandates offer greater control over recurring payments, minimizing the risk of unauthorized deductions.

- Boosted Digital Economy: These changes are expected to further promote the adoption of digital payments in India, leading to a more efficient and transparent financial ecosystem.