Home Loan Calculator Details

Home Loan Calculator Details

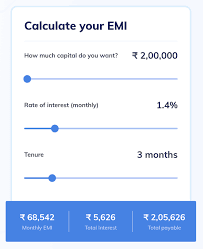

A Home Loan Calculator is a financial tool that helps borrowers estimate their monthly loan repayment (EMI), total interest payable, and total repayment amount based on inputs such as loan amount, interest rate, and loan tenure.

Purpose of a Home Loan Calculator

- Estimate Monthly EMIs: Helps users know how much they’ll pay every month.

- Financial Planning: Assists in budgeting and understanding affordability.

- Compare Loans: Useful for comparing loan offers from different banks.

- Time-Saving: Eliminates the need for manual calculations.

How Does It Work?

A home loan calculator uses the EMI formula to determine the monthly payment.

✳️ EMI Formula:

\text{EMI} = \frac{P \times R \times (1+R)^N}{(1+R)^N - 1}

Where:

- = Principal Loan Amount

- = Monthly Interest Rate = Annual Rate / 12 / 100

- = Loan Tenure in Months

Key Components

| Parameter | Description |

|---|---|

| Loan Amount (P) | The total amount borrowed from the bank/lender. |

| Interest Rate (R) | Annual interest rate charged by the lender. |

| Loan Tenure (N) | Duration of loan repayment (in months or years). |

| EMI | Equated Monthly Installment – fixed monthly payment including interest. |

| Total Interest | Total interest paid over the entire tenure. |

| Total Amount Payable | Sum of loan amount and total interest. |

Example Calculation

Let’s assume:

- Loan Amount = ₹50,00,000

- Interest Rate = 8.5% per annum

- Tenure = 20 years (240 months)

Step 1: Convert annual rate to monthly rate

R = \frac{8.5}{12 \times 100} = 0.007083

Step 2: Apply EMI formula

EMI = \frac{50,00,000 \times 0.007083 \times (1 + 0.007083)^{240}}{(1 + 0.007083)^{240} - 1}

\approx ₹43,391

Step 3: Calculate total values

- Total Payment = ₹43,391 × 240 = ₹1,04,13,840

- Total Interest = ₹1,04,13,840 − ₹50,00,000 = ₹54,13,840

️ Features of a Good Online Home Loan Calculator

| Feature | Description |

|---|---|

| Interactive Sliders | For adjusting amount, rate, and tenure easily. |

| Instant Results | EMI, interest, and total payment shown immediately. |

| Graphical Breakdown | Pie chart of principal vs. interest. |

| Prepayment Option | Estimate the impact of part prepayments. |

| Printable Output | For documentation or record keeping. |

Benefits of Using a Home Loan EMI Calculator

- ✔️ Accuracy: Avoids manual miscalculation.

- ✔️ Speed: Instant results within seconds.

- ✔️ Scenario Analysis: Helps test various loan options.

- ✔️ Better Decision-Making: Choose the most affordable loan.

Pro Tips

- Always check processing fees or hidden charges separately.

- Opt for shorter tenure if you want to reduce interest payout.

- Compare fixed vs. floating interest rates.

- Use the calculator before applying to assess eligibility and EMI

Jobs Tripura is a Professional Educational Platform. Here we will provide you only interesting content, which you will like very much. We’re dedicated to providing you the best of Educational , with a focus on dependability and Jobs . We’re working to turn our passion for Educational into a booming online website

Post Comment